Most consumers recognize the value in hiring professionals in a field they are not experts in. Approximately 90% of home sellers and buyers hire a real estate brokerage to represent their home sale and purchase. The resources, expertise, and consultation with a strong agent is worth its weight in gold.

In 2024, new agency law clarified the way real estate brokerages are compensated.

Brokerage compensation has ALWAYS been negotiable. There have always been a variety of compensation structures and varying levels of services available out there.

The most familiar model has involved the brokerage compensation being paid from the proceeds of the sale. A listing agreement would state the agreed upon compensation and this was shared with the cooperating brokerage if another agent/broker worked the buyer side of the transaction.

Due to some misunderstandings, and after lengthy legal discussions nationally, new laws (2024) around how brokerage compensation is written in agency contracts have come about.

What’s New?

The specifics may vary slightly from state to state. However, across the country, commission agreements must be ‘de-coupled’. The listing brokerage compensation is separated from the buyer brokerage compensation.

For example, what was previously written as a 6% commission split 50/50 is now shown as 3% to the listing broker and 3% to the buyers broker.

Buyer Agency Agreements MUST now include what the compensation is for the Buyer Brokerage services. These agreements MUST be signed prior to any showings.

A seller still has the option to allow the commissions to be baked into the sale price. This is beneficial to Buyers so that the commissions can be rolled into their mortgage.

a seller’s options

A listing consultation will include a conversation around whether or not to include all or some of the buyer’s brokerage commissions to be paid within the purchase price. When a Seller is weighing their options with a compensation agreement, they must consider a variety of factors as it relates to both buyers and what scenario will ultimately net them the highest proceeds.

REMEMBER, the purchase price of the house is NOT what the buyer is the most concerned with. It is ultimately their monthly mortgage payment that dictates their ability to purchase any particular property. In a scenario where they have to pay their brokerage fees separately from the sale of the property, it skews their numbers (sometimes significantly) and could impact the amount they are willing/able to pay.

The BUYER is the one bringing the cash to the table. Without the buyer, there is no money and no sale. When you think about it, it has always been the Buyer’s money paying the commissions. I know some will argue this point, but the fact remains that increasing a buyers closing costs will impact their buying power and should be carefully considered.

When looking at comparable sales within your neighborhood, the sold price doesn’t tell the whole story. There are other terms negotiated that impact a buyer’s willingness to purchase a home that you may not be privy to. Because of new MLS laws, we no longer know who offered brokerage compensation and who didn’t. Be sure to discuss the other potential terms with your agent so you are prepared for fair negotiations.

Removing the commissions from the purchase price may also reduce the buyer demand. Many buyers have saved for years to have a down payment. Sellers should be prepared for the possibility that the commission structure may reduce the number of buyers who have interest in the home.

Be careful to study the numbers! If a mortgage buyer needs to be within a certain monthly budget, their buying power can swing significantly with both mortgage rates, mortgage insurance, and closing costs. Increased closing costs could decrease their offer price in order to maintain a comfortable monthly payment. This COULD end up with a LOWER net for the seller depending on the specifics.

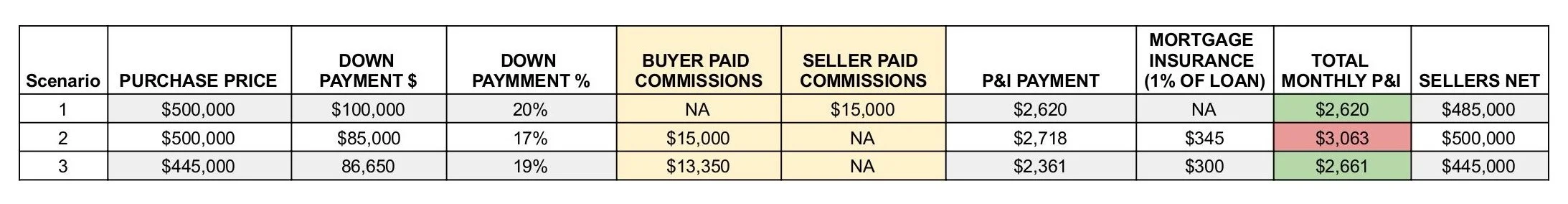

The chart below provides a basic representation of a possible scenario.

A home listed at $500,000. The buyer has $100,000 saved for their down payment. Their budget does allow them to pay more than $2,700/month for the P&I mortgage payment.

Remember that below a 20% downpayment, we typically have to factor in mortgage insurance on top of the principal + interest.

Scenario 1 is the traditional model where the commissions are baked into the sale price.

Scenario 2 is if the Buyer pays the asking price + commission outside of the purchase price.

Scenario 3 is if the Buyer is paying the commission separate from the purchase price, but needs to adjust the purchase price to maintain their desired monthly payment.

Each situation and each transaction will of course be different, but the point is that it’s important to really consider the whole picture and varying factors when deciding how to approach your listing agreement and negotiations. Removing the option for commissions to be paid from the sale price does not always mean higher proceeds. In the above scenario, it would have net the seller MORE if they allow the brokerage compensation to be paid within the sale price.

When you are ready to list your property, your agent will go through the scenarios with you and discuss the best approach for your home and local market!